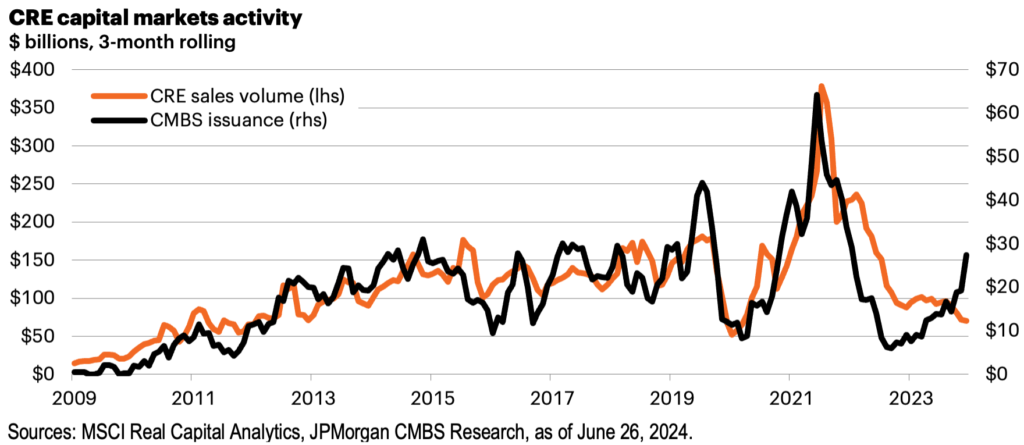

The commercial real estate (CRE) market in the U.S. has remained resilient, despite ongoing challenges brought by rising interest rates and an increase in new property supply. While the fundamentals of the market remain strong, elevated financing costs have stifled transactions, leading to a standoff between buyers and sellers. Although deal activity has been relatively dormant, there is cautious optimism that the market is forming a trough. A key reason for this optimism lies in the decline in construction activity, which may create a supply shortage and drive future growth in property incomes.

Key Insights:

The first half of 2024 saw muted transaction activity as financing costs kept potential buyers sidelined. However, we may start to see signs of recovery in the second half, especially as new construction slows and demand for space remains robust across key property sectors. Multifamily and industrial demand has leveled off at sustainable levels, while retail has emerged as an unexpected performer, with decreasing vacancy rates and positive net absorption in recent quarters.

Supply and Demand Dynamics

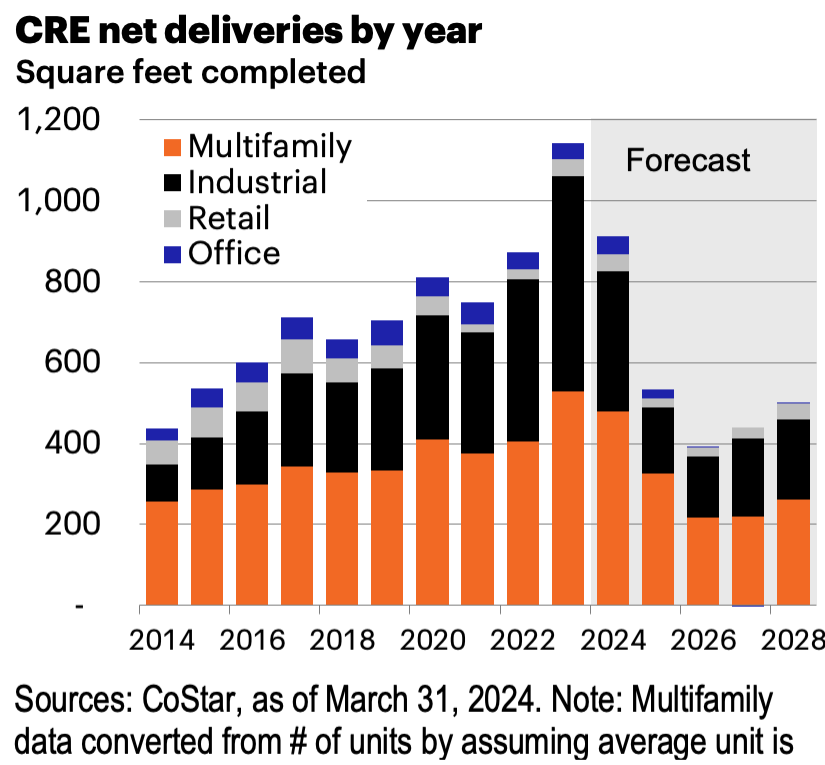

Despite the uptick in vacancy rates across most sectors due to new

completions, demand for commercial space remains solid. Over the past year, the U.S. delivered 612,000 new multifamily units and 515 million square feet of industrial space, reflecting a significant increase in supply. However, this wave of new supply may be short-lived, as construction activity is already declining sharply, with both multifamily and industrial groundbreakings falling to levels last seen in the early 2010s.

The decline in new construction is largely attributed to rising financing costs, which have made it more difficult for developers to break ground on new projects. This decline in construction is expected to lead to a supply gap in the coming years, especially in sectors like multifamily and industrial, where demand remains strong. As a result, we anticipate that vacancy rates will fall and rent growth will reaccelerate over the medium term.

The Path Forward

While the immediate outlook for the CRE market remains uncertain, the long-term dynamics are starting to take shape. The slowdown in new construction, combined with sustained demand for space, could set the stage for a more balanced market in the coming years. As the market adjusts to higher interest rates and investors gain confidence in the underlying fundamentals, we may see a gradual increase in transaction activity.

Higher rent growth, however, could also keep interest rates elevated for longer than expected, as rent costs continue to play a significant role in overall inflation. This dynamic could create new challenges for the market, but it also offers opportunities for savvy investors who are well-positioned to navigate the changing landscape.

In conclusion, the U.S. commercial real estate market in Q3 2024 remains in a period of transition. While higher financing costs and a wave of new supply have created short-term challenges, the long-term outlook is more optimistic, particularly as construction activity slows and demand remains strong. Investors who can adapt to the evolving environment may find promising opportunities as the market begins to thaw.

© 2016-2025 SharpLine® All rights reserved.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |