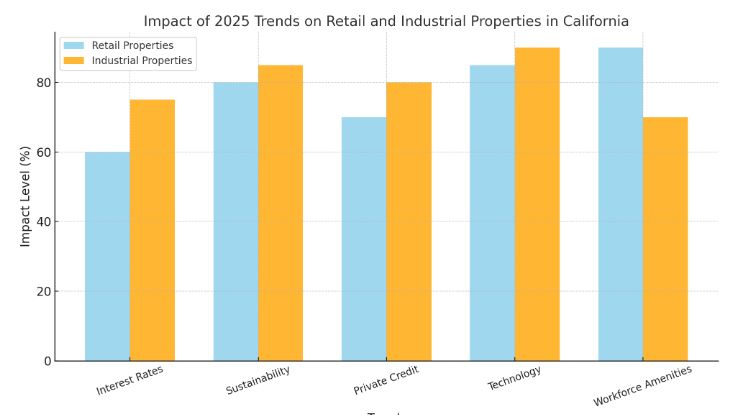

As we enter 2025, the capital markets are navigating a dynamic landscape shaped by evolving macroeconomic conditions, emerging technologies, and shifting investor preferences. Here are the top trends shaping capital markets this year, with a special focus on retail and industrial properties in California.

Central banks worldwide, including the Federal Reserve, are expected to maintain elevated interest rates to combat inflation. Higher borrowing costs will influence investment decisions across asset classes, particularly in the real estate sector, where financing is critical. Projections from Oxford Economics suggest the federal funds rate will remain above 5% through much of 2025, keeping borrowing costs elevated for both businesses and consumers.

For industrial properties, demand remains resilient due to e-commerce growth, but financing challenges may temper speculative developments.

Retail properties, particularly in affluent areas, are seeing investors focus on experiential retail and mixed-use developments to offset higher costs.

Environmental, social, and governance (ESG) considerations continue to gain traction. Investors are prioritizing assets that align with sustainability goals and demonstrate strong governance practices. In CRE, this translates to increasing demand for green buildings and energy-efficient properties.

Industrial properties in California are integrating solar energy and advanced HVAC systems to meet the state’s stringent environmental standards.

Retail properties are adopting eco-friendly designs, with some malls integrating green rooftops and EV charging stations.

Private credit markets are expanding as institutional investors seek alternative assets offering higher returns. In the CRE sector, private lenders are stepping in to fill gaps left by traditional banks tightening their lending standards.

Private lenders are increasingly funding industrial developments in Inland Empire, a key logistics hub.

Retail investors are using private credit to redevelop underperforming malls into mixed-use spaces.

Advancements in technology are reshaping capital markets and CRE in unprecedented ways. From AI-driven analytics to blockchain-enabled transactions, technology is streamlining processes and enhancing decision-making.

Industrial facilities in California are adopting automation and AI-driven inventory systems to improve efficiency.

Retail centers are leveraging data analytics to curate tenant mixes and optimize customer engagement.

Multifamily properties remain a favorite among investors due to stable cash flows and strong demand driven by housing shortages in key markets.

While multifamily is dominant, mixed-use projects combining retail, multifamily, and office are increasingly popular in urban areas.

Investors are targeting suburban regions in California for higher yields and reduced competition.

The healthcare sector is attracting significant investor attention due to the aging population and the growing demand for medical facilities. Healthcare real estate, including medical office buildings and senior living communities, is becoming a vital asset class.

Investors are targeting medical office spaces in suburban California markets, where demand for outpatient services is surging.

Senior housing developments are expanding in high-growth areas like Sacramento and San Diego.

Capital markets in 2025 are defined by adaptability and innovation. Investors who can navigate interest rate pressures, embrace sustainability, and leverage technology will be well-positioned for success. As these trends unfold, staying informed and partnering with industry experts will be crucial in identifying opportunities and mitigating risks.

For Inquiries : contactus@sharplinecre.com

RELATED ARTICLES

Sources : (1) Federal Reserve Economic Projections, Oxford Economics (2) U.S. Green Building Council (3) Preqin Private Credit Report (4) CB Insights on Real Estate Tech Trends (5) National Multifamily Housing Council (NMHC) (6) Healthcare Real Estate Insights

© 2016-2025 SharpLine® All rights reserved.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |